Retailers quietly slash prices of AMD's and Intel's latest EPYC and Xeon CPUs by up to 50%

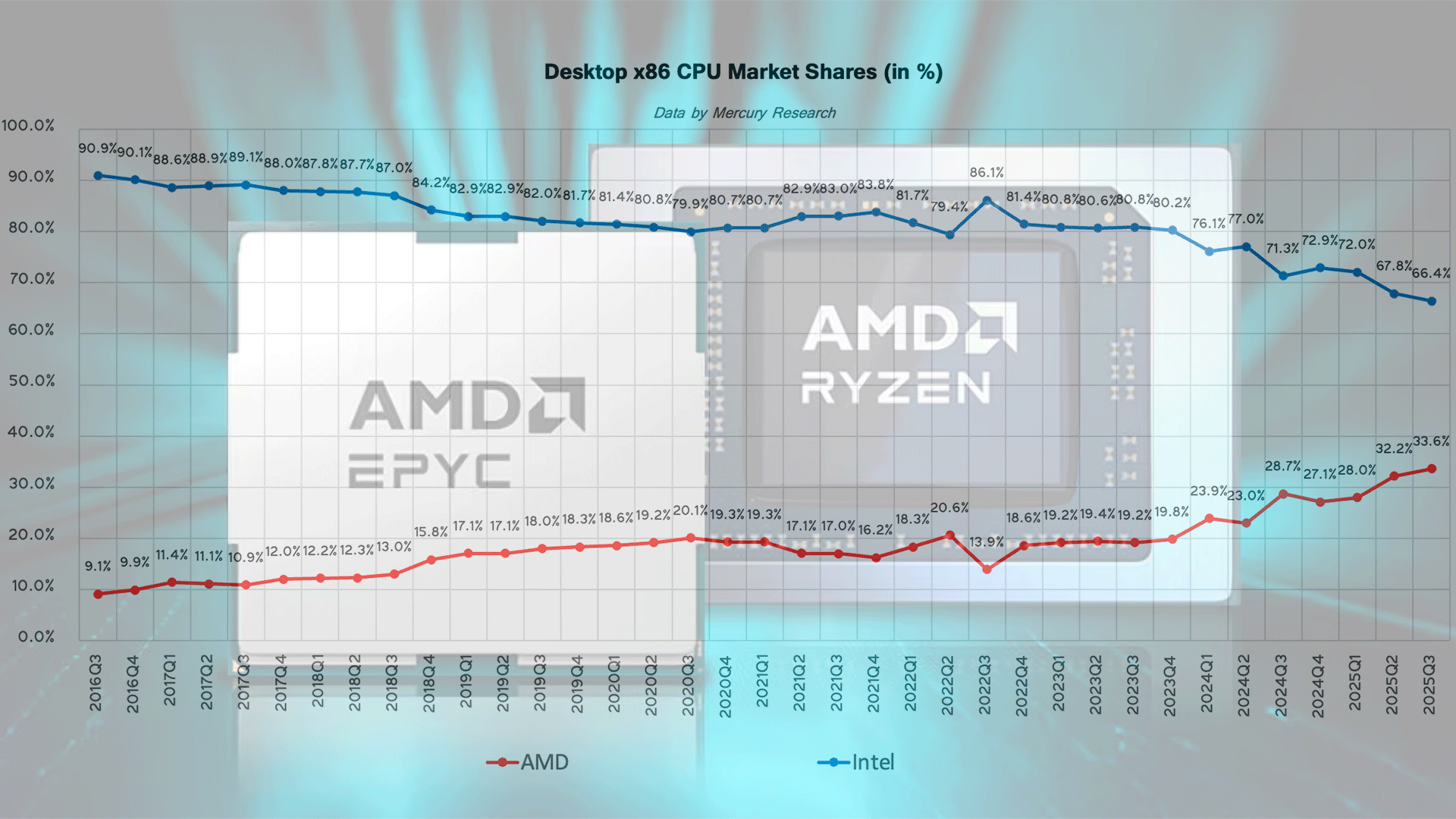

On the revenue front, AMD reached another record quarter for desktop CPU revenue, driven by higher shipments and a strong mix of premium SKUs, as the company noted in its conference call a week ago. Intel's revenue position weakened as its unit share declined and AMD absorbed more of the market's high-margin demand. Mercury Research notes that AMD's revenue growth in desktops significantly outpaced its unit growth, which confirms that the red company continued to strengthen its position in the most profitable parts of the desktop market.

AMD lost market share to Intel in the mobile CPU space in Q1 and Q2 2025, but the company outperformed Intel in Q3 2025 on a sequential basis, gaining unit share as Intel struggled with reduced shipments of its entry-level small-core processors.

AMD's mobile CPU unit share rose from 20.6% in Q2 to 21.9% in Q3, a sequential gain of 1.4%, while Intel's share fell from 79.4% to 78.1%, down 1.4% QoQ. Intel did manage to grow shipments slightly, but well below normal seasonal levels, allowing AMD to capture market share during the quarter, according to Mercury Research. Nonetheless, AMD lost 0.4% market share year-over-year, whereas Intel gained 0.4%.

On the revenue side, the mix probably favored both companies but helped AMD more. Intel's shortage of low-end CPUs pushed its average selling prices upward, while AMD — which does not have direct rivals for Intel Atom-like SoCs — benefited from increased shipments of mid-range and premium Ryzen mobile processors as Intel faced some shortages on this side of the spectrum as well.

In the server CPU market, Q3 2025 saw relatively flat unit shipments overall, but while AMD managed to edge out another small gain, its gains have been negligible this year. Then again, although the sequential movement was modest, it continued the longer-term trend of AMD steadily expanding its presence in x86 servers.

AMD's server unit share increased from 27.3% in Q2 to 27.8% in Q3, while Intel's share slipped 0.5% to 72.2%. Both companies saw YoY shipment growth, but AMD's increase was stronger, helping it push unit share higher compared to the same quarter a year earlier, so overall things look good for AMD.

Most of the real action in Q3 came from product mix rather than volume, according to Mercury. AMD's EPYC 'Turin' ramp accelerated, driving stronger demand for high-core-count EPYC processors, while Intel saw increasing adoption of Xeon 6 'Granite Rapids,' which helped lift its average selling prices despite slightly lower unit volumes.

On the revenue side, AMD hit another all-time high, as the mix shifted heavily toward its latest and more expensive EPYC 9005-series platform. The combination of flat unit shipments and rising prices meant that AMD's server revenue continues to grow significantly faster than its unit share, while Intel's revenue gains were more limited due to modest declines in its overall shipment mix.

In terms of unit share, AMD continued to gain ground in Q3 2025 across nearly all major x86 segments, helped by strong desktop growth driven by the halo effect of range-topping Ryzen 9000-series CPUs and Intel's struggles to ship enough previous-generation desktop CPUs, as well as the relatively low popularity of its latest offerings for desktops. As a result, AMD expanded its presence in client CPUs, reached a new high in desktops, and inched upward in servers, while Intel's share declined modestly as supply constraints and product transitions limited its ability to address all orders. Although Intel still led the market in total shipments, the balance continued shifting gradually toward AMD.

In terms of revenue, AMD delivered even stronger results, setting new highs in both desktop and server segments thanks to rising sales of premium processors and the ramp of its newest platforms. Intel's revenue performance was more mixed: constrained low-end supply pushed its average prices higher, but it ceded more of the high-margin market to AMD, especially in desktops and enterprise servers. Then again, the company announced price hikes of its popular Raptor Lake processors, which will impact its results in Q4.

Follow Tom's Hardware on Google News , or add us as a preferred source , to get our latest news, analysis, & reviews in your feeds.

Anton Shilov Social Links Navigation Contributing Writer Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

Amdlova 25 years seen that chart Now I want see x86 x arm =] Reply

Key considerations

- Investor positioning can change fast

- Volatility remains possible near catalysts

- Macro rates and liquidity can dominate flows

Reference reading

- https://www.tomshardware.com/pc-components/cpus/SPONSORED_LINK_URL

- https://www.tomshardware.com/pc-components/cpus/amd-continues-to-chip-away-at-intels-x86-market-share-company-now-sells-over-25-percent-of-all-x86-chips-and-powers-33-percent-of-all-desktop-systems#main

- https://www.tomshardware.com

- Samsung raised memory chip prices by up to 60% since September, according to reports — AI data center build out strangles supply

- Deutsche Telekom and NVIDIA Launch Industrial AI Cloud — a New Era for Germany’s Industrial Transformation

- Distributors force unprecedented RAM and motherboard bundle mandate to fight global shortage, report claims — distributors require one-to-one ratio from buyers

- Tesla targets AI data centers with massive Megapack batteries as grid-strain fears grow — says $50B/GW for a 2-hour system over a 20-year lifetime is 'outsized

- AMD's FSR Redstone officially debuts in Call of Duty: Black Ops 7 — AMD's answer to Nvidia's Ray Reconstruction

Informational only. No financial advice. Do your own research.