TSMC posts record quarter results as skyrocketing AI and HPC demand drives two-thirds of revenue — company pulls in $33.1 billion

More telling is what this bounce tells us about AMD’s design focus. While Intel’s Meteor Lake platform continues to find traction with its integrated NPU push , AMD has leaned into gaming-first, performance-per-watt silicon . As a result, AMD has clawed back meaningful share in premium laptop designs.

On the data center side, AMD reported $4.3 billion in revenue (a 22% year-over-year increase), driven by stronger EPYC adoption and meaningful Instinct MI300X shipments. This is the first quarter in which AMD has made a serious dent in the accelerator business, which it has long trailed Nvidia in. That growth came without any revenue from China-bound MI308 shipments, which were blocked under ongoing U.S. export restrictions and domestic bans in China . AMD confirmed Q3 and Q4 guidance excludes those entirely.

The company’s focus isn’t just on GPUs; it’s also building a vertically aware, modular, open platform. Announced back in June and dubbed Helios, AMD’s cabinet reference design combines MI400-class accelerators, EPYC “Venice” CPUs, and Pensando “Vulcano” AI NICs, all connected via Ultra Ethernet . The goal is to win over hyperscalers and HPC customers looking for a coherent, Ethernet-native alternative to Nvidia’s NVLink- and InfiniBand-centric products.

AMD’s Helios pitch is part of a long-term strategy to offer a full-stack, open alternative to Nvidia’s vertically integrated systems. While Helios is built around the upcoming MI400-series GPUs, AMD’s current MI355X — its top-end CDNA 4 part for 2025 — already reflects the shift toward inference-first workloads.

With 288GB of HBM3E, support for FP4 and INT4, and aggressive focus on cost-per-token rather than peak FLOPs, MI355X is optimized for large-scale inference where memory bandwidth and low-precision throughput matter most. AMD is explicitly targeting the economics of production AI, not just training benchmarks .

Oracle, one of AMD’s largest cloud customers, is already rolling out MI300- and MI350-based infrastructure, and plans to adopt MI400-series platforms starting in 2026.

The most significant long-term threat to AMD’s data center business may not be in GPUs at all. In September, Nvidia and Intel announced an unexpected partnership that includes a custom x86 CPU built on Intel 18A, designed specifically for future Nvidia platforms. If it becomes the default attach CPU for Nvidia’s Rubin or GB300-class AI systems, AMD’s share of the server CPU footprint inside Nvidia-designed racks could shrink.

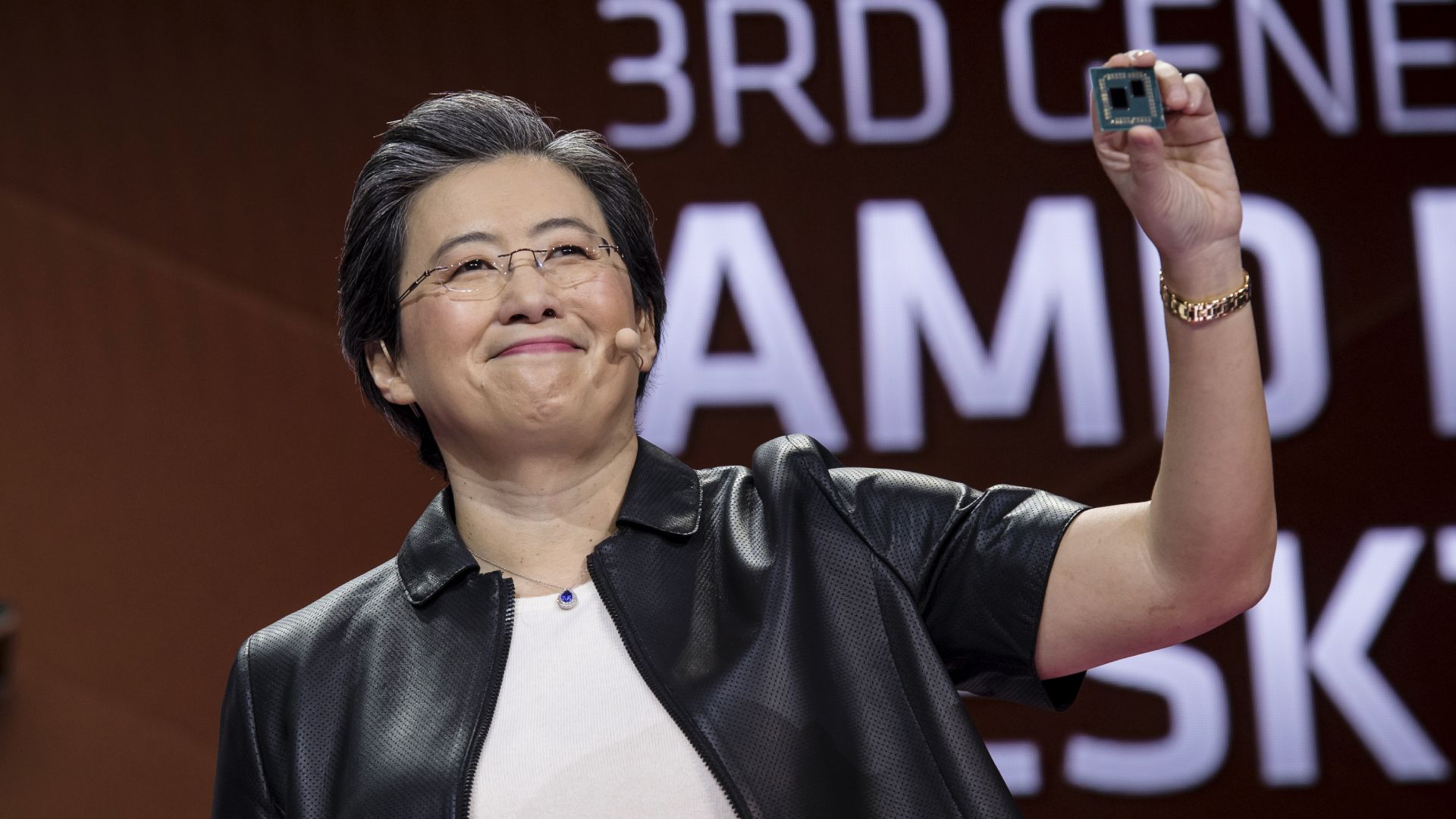

Ryzen 7 9800X3D sales help AMD hit record-breaking $2.8 billion in client revenue for Q3 2025

Nvidia posts $46 billion revenue in another record quarter

Key considerations

- Investor positioning can change fast

- Volatility remains possible near catalysts

- Macro rates and liquidity can dominate flows

Reference reading

- https://www.tomshardware.com/tech-industry/semiconductors/SPONSORED_LINK_URL

- https://www.tomshardware.com/tech-industry/semiconductors/amd-record-quarter-shows-strength-but-data-center-dominance-could-be-out-of-reach#main

- https://www.tomshardware.com

- NVIDIA IGX Thor Robotics Processor Brings Real-Time Physical AI to the Industrial and Medical Edge

- Dutch government allegedly folds to supply chain pressure, will relinquish control of Nexperia in China spat — reports say deal contingent upon China allowing f

- AMD warns the Intel and Nvidia partnership is a risk to its business — quarterly report outlines risk from 'increased competition and pricing pressure'

- $5,000 Corsair pre-built keeps on frying Intel CPUs due to lack of BIOS update, tech alleges — kills three Intel Core i9 chips because latest version still does

- Explosive AI buildout brings into question water supply concerns — exploring how data centers could curb water demands

Informational only. No financial advice. Do your own research.