When you purchase through links on our site, we may earn an affiliate commission. Here’s how it works .

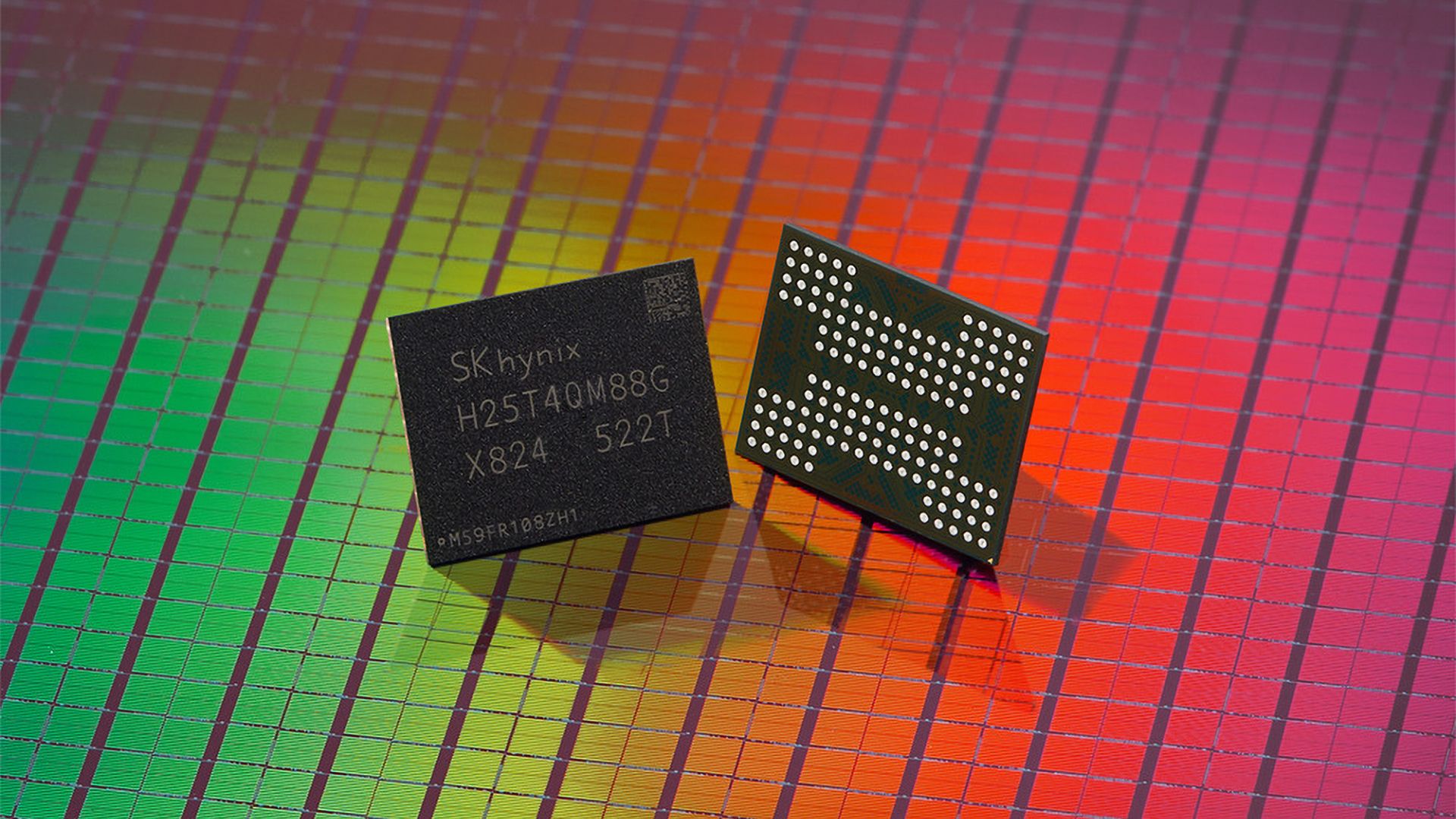

(Image credit: SK hynix) TrendForce reported on December 1 that NAND Flash wafer supply tightened sharply in November as AI workloads and enterprise SSD orders continued to drive sustained demand. The firm said suppliers have prioritized capacity for higher-margin enterprise and premium products while stepping back from older manufacturing nodes. That shift has reduced the available pool of mainstream wafers and pushed monthly contract prices up by 20% and more than 60% across all major product categories.

The steepest increases landed with TLC. TrendForce noted that 1Tb TLC remained in short supply through November because enterprise SSD demand has not eased, and the firm described its average contract-price rise as “sharp.” The fastest phase-out of legacy process nodes affected the 512Gb TLC segment, which experienced the largest jump of the month with an increase of more than 65%. TrendForce added that 256Gb TLC also saw renewed pressure as further legacy-node shutdowns reduced inventory and aggravated an already tight market.

The same pattern extended into QLC products. TrendForce said the supply chain became “much tighter” in November as high-capacity enterprise drives continued to gain traction in cloud infrastructure and cold-storage applications. That shift pushed 1Tb QLC into significant price increases, reinforcing the broader theme that capacity-oriented segments are being pulled upward by data-center demand. Even MLC, which tends to move on the cadence of embedded and industrial customers, recorded higher average selling prices during the month due to steady orders in those markets.

SanDisk reportedly jacks up flash prices by 50% as memory makers cash in on AI-fueled demand

Phison CEO confirms NAND prices have more than doubled and all 2026 production already sold out

HDDs on backorder for two years as AI datacenters trigger shortage

Key considerations

- Investor positioning can change fast

- Volatility remains possible near catalysts

- Macro rates and liquidity can dominate flows

Reference reading

- https://www.tomshardware.com/tech-industry/SPONSORED_LINK_URL

- https://www.tomshardware.com/tech-industry/nand-wafer-shortage-pushes-november-contract-prices-up#main

- https://www.tomshardware.com

- Xbox expansion drive from Seagate crashes to lowest ever price — install more games with 2TB of snappy storage for just $184, just 9 cents per GB

- Industry's first TSMC COUPE-based optical connectivity solution for next-gen AI chips displayed — Alchip and Ayar Labs show future silicon photonics device

- NVIDIA Accelerates AI for Over 80 New Science Systems Worldwide

- Grab a 49-inch OLED ultrawide monitor at Amazon UK for less than £700 — MSI MPG 491CQP drops to lowest-ever price

- Chinese vendor showcases first mass-produced Imagination DXD GPU with ray tracing — sports modern features like super resolution, too

Informational only. No financial advice. Do your own research.