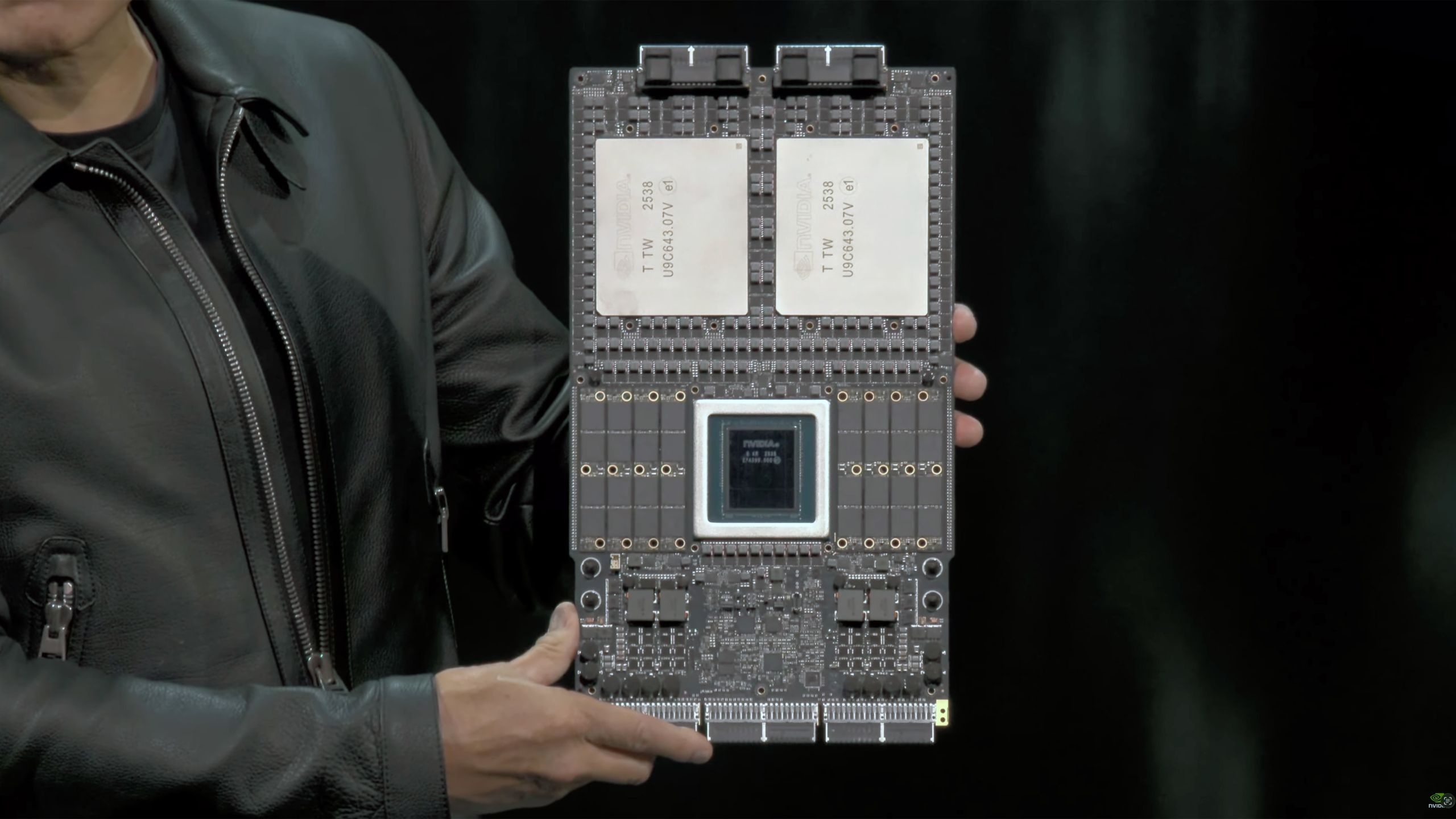

Nvidia's Vera Rubin platform consists of the dual-chiplet Rubin GPU with 288 GB of HBM4 memory, the Rubin CPX accelerator with 128 GB of GDDR7 for the next-generation Vera CPU with 88 custom cores, the BlueField-4 DPU, a 6th-generation NVLink switch for scale-up scalability, and next-generation Ethernet and InfiniBand adapters for scale-out connectivity. All of the chips belonging to the Vera Rubin platform have taped out, and Nvidia has working silicon .

As AI is getting adopted by a wide range of companies, government agencies, and scientific organizations all around the world, the company can sell tons of its AI accelerators and adjoining chips. Therefore, the company is reportedly set to achieve the $0.5 trillion goal without taking into account China, its third-largest market just a year ago. Earlier this year, the U.S. government banned sales of all advanced AI processors (including AMD's cut-down Instinct MI308 and Nvidia's cut-down H20 GPUs) to China, whereas recently, Beijing forbade government organizations from buying foreign hardware, instead relying on domestic alternatives as part of the ongoing trade war between the U.S. and China.

Due to uncertainties with sales to China, Nvidia no longer includes the People's Republic in its revenue forecasts.

"We have said for some time now, our forecast for China is zero," Huang said. "[…] We would love the opportunity to be able to re-engage the Chinese market with the excellent products that we deliver and to be able to compete globally. The Chinese [AI] market is very large. This year, my guess is probably about $50 billion. […] We are going to continue to engage the U.S. government, continue to engage the China government to advise them and to encourage them to allow us to go back and compete in the open market. Until then, we should assume zero."

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Key considerations

- Investor positioning can change fast

- Volatility remains possible near catalysts

- Macro rates and liquidity can dominate flows

Reference reading

- https://www.tomshardware.com/pc-components/gpus/SPONSORED_LINK_URL

- https://www.tomshardware.com/pc-components/gpus/nvidia-hints-at-early-vera-rubin-launch-on-track-for-usd500-billion-in-gpu-sales-by-late-2026-despite-losing-china#main

- https://www.tomshardware.com

- Dell and HP disable hardware H.265 decoding on select PCs due to rising royalty costs — companies could save big on HEVC royalties, but at the expense of users

- One Giant Leap for AI Physics: NVIDIA Apollo Unveiled as Open Model Family for Scientific Simulation

- AMD's chart-topping Ryzen 7 9800X3D is on sale at Amazon right now for Black Friday — save $30 on the king of gaming CPUs

- AI On: 3 Ways to Bring Agentic AI to Computer Vision Applications

- The Great Flip: How Accelerated Computing Redefined Scientific Systems — and What Comes Next

Informational only. No financial advice. Do your own research.