The Nvidia H200 export saga, as it happened — Beijing ponders response and buyers line up

Nvidia weighs expanding H200 production as new China orders rush in, report claims

Chinese authorities have not yet cleared the shipments, but the scale of interest and Nvidia’s offer to open new H200 production capacity in 2026 suggest that they expect capitulation from Beijing authorities, which, given how far ahead the H200 is of anything Chinese fabs can produce, is understandable.

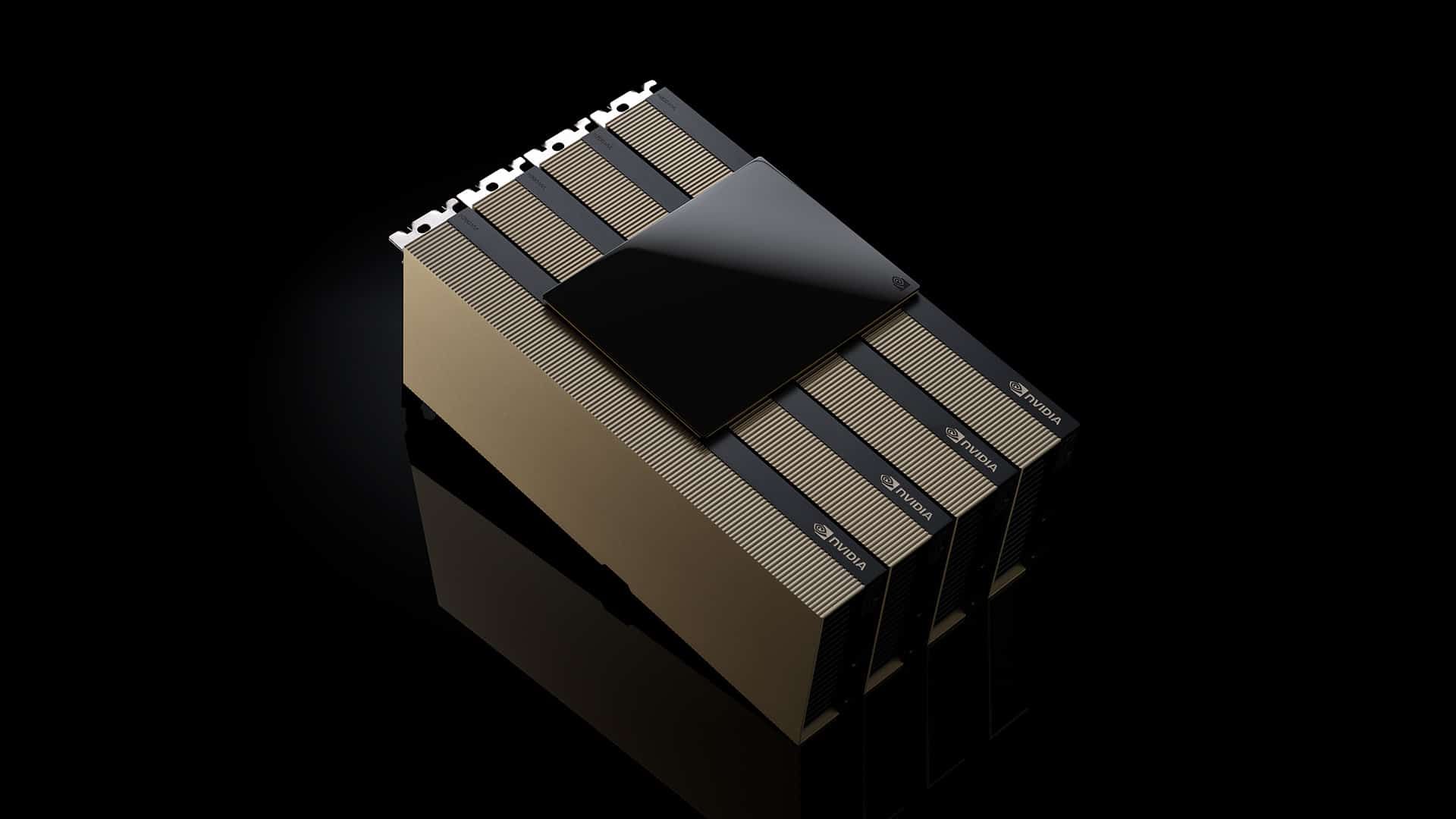

The Biden administration’s export controls on AI chips to China, which began in 2022 and expanded through 2023, had cut off access to Nvidia’s A100, H100, and H200 silicon. In response, Nvidia designed lower-performing parts specifically for the Chinese market. The H20 was the most powerful of these, but still underperformed relative to the training needs of large foundation models. Chinese firms adapted, turning to Huawei’s Ascend series and other local vendors, but none of those efforts matched the performance envelope of Hopper-based GPUs.

In early December, Trump overrode the existing restrictions, allowing H200 chips to be sold into China, provided each deal is subject to inter-agency approval and includes a 25% levy. The decision does not extend to Nvidia’s current Blackwell or upcoming Rubin GPUs. In effect, the U.S. is granting limited access to older silicon under strict financial and procedural oversight, while keeping cutting-edge hardware firmly out of reach.

The Trump administration’s backtracking also gives Nvidia a reason to reintroduce H200 production. The company had largely transitioned away from Hopper-class manufacturing to focus on next-gen designs, but in light of demand from China and a green light from Washington, Nvidia has signaled that it will take new H200 orders starting in 2026. While modest in scale compared to Blackwell, this production would serve a lucrative niche: international buyers whose political or technical environments preclude access to newer chips.

All this has created a dilemma for China’s domestic chip ambitions . The H200 is far more powerful than any domestically produced alternative, but reliance on it may hinder progress toward a self-sufficient AI hardware stack. Huawei’s Ascend 910C, for instance, trails the H200 significantly in both raw throughput and memory bandwidth. Biren’s BR104 is similarly constrained, and the underlying Chinese software ecosystem remains heavily CUDA-dependent. Switching to Nvidia’s Hopper parts offers immediate compatibility with existing workflows, whereas transitioning to local chips will require building a software infrastructure from the ground up.

This performance and integration gap is one reason the H200 is so attractive to buyers in China. We already know that the chip is being used unofficially, and there have been several high-profile attempts to skirt around import restrictions through black- and grey-market channels. Even university labs and medical research institutions with ties to the military have reportedly acquired H200s through indirect channels, sometimes via foreign subsidiaries or offshore procurement.

Nvidia reportedly wins H200 exports to China

Key considerations

- Investor positioning can change fast

- Volatility remains possible near catalysts

- Macro rates and liquidity can dominate flows

Reference reading

- https://www.tomshardware.com/tech-industry/semiconductors/SPONSORED_LINK_URL

- https://www.tomshardware.com/tech-industry/semiconductors/nvidia-prepares-h200-shipments-to-china-as-chip-war-lines-blur#main

- https://www.tomshardware.com

- [Daily Due Diligence] NVDA NVDA

- Get a pre-built PC with 32GB of RAM for under $1,000 — this mid-range gaming desktop delivers decent performance for an affordable price during these trying tim

- Game the Halls: GeForce NOW Brings Holiday Cheer With 30 New Games in the Cloud

- NVIDIA Acquires Open-Source Workload Management Provider SchedMD

- 'This memory situation is a multi-year problem,' says Maingear CEO — Custom PC company offers up BYO RAM builds to combat shortages

Informational only. No financial advice. Do your own research.