Follow Tom's Hardware on Google News , or add us as a preferred source , to get our latest news, analysis, & reviews in your feeds.

Jon Martindale Freelance Writer Jon Martindale is a contributing writer for Tom's Hardware. For the past 20 years, he's been writing about PC components, emerging technologies, and the latest software advances. His deep and broad journalistic experience gives him unique insights into the most exciting technology trends of today and tomorrow.

Zaranthos They say they have no plans to increase production but that's nonsense. If they don't increase production along with demand new competition will flood in to fill the gaps and most of that would come from China which is exactly what most wouldn't want. A growing number of countries are wising up to relying too heavily on China for goods, especially technology. Having your supply chain at the mercy of the whims of the CCP or susceptible to the build in surveillance tech China uses to spy on its own people gives them reason for concern. There will be growing pains, and that will include increased prices, but usually there is an overall benefit in the end. R&D will increase, production will increase, and when the AI insanity calms down or the bubble bursts prices will fall and higher end tech will fall into normal consumers price ranges again. Reply

BelowTheL1ne This is fake news. Ram and m.2 drive prices continue to fall like always. Demand just isnt there for consumers because most people do not need the speeds and have realized it. They have priced in this cost already from production but it doesnt sell. Reply

acadia11 Zaranthos said: They say they have no plans to increase production but that's nonsense. If they don't increase production along with demand new competition will flood in to fill the gaps and most of that would come from China which is exactly what most wouldn't want. A growing number of countries are wising up to relying too heavily on China for goods, especially technology. Having your supply chain at the mercy of the whims of the CCP or susceptible to the build in surveillance tech China uses to spy on its own people gives them reason for concern. There will be growing pains, and that will include increased prices, but usually there is an overall benefit in the end. R&D will increase, production will increase, and when the AI insanity calms down or the bubble bursts prices will fall and higher end tech will fall into normal consumers price ranges again. From who, aside from dram manufacturers acting as a cartel, who is the competition you speak of … you have samsung, sk Hynix, and micron making today’s DDR5 dram if someone could have broken into the cadre they would have done so. These are the folks that can produce the speed and capacities and have the tech to do it today. It’s like saying a new player is going to pop up as a tool manufacturer to compete with ASML or TSMC in leading edge node production. It takes years of investment and oodles of money to build factories and considering the demands if it was that simple would have happened already. The IC market is a mature market not a revolutionary market where new players can just jump in and be advanced enough to to compete. Reply

tamalero Didnt these clowns reduce production because of oversupply like a year or so ago? Reply

tjvaldez01 acadia11 said: From who, aside from dram manufacturers acting as a cartel, who is the competition you speak of … you have samsung, sk Hynix, and micron making today’s DDR5 dram if someone could have broken into the cadre they would have done so. These are the folks that can produce the speed and capacities and have the tech to do it today. It’s like saying a new player is going to pop up as a tool manufacturer to compete with ASML or TSMC in leading edge node production. It takes years of investment and oodles of money to build factories and considering the demands if it was that simple would have happened already. The IC market is a mature market not a revolutionary market where new players can just jump in and be advanced enough to to compete. I agree that a non-Chinese company can't just jump in and compete. However, YMTC is adding capacity as fast as it can and may pose a mear-term problem. We shall see how this plays out. Reply

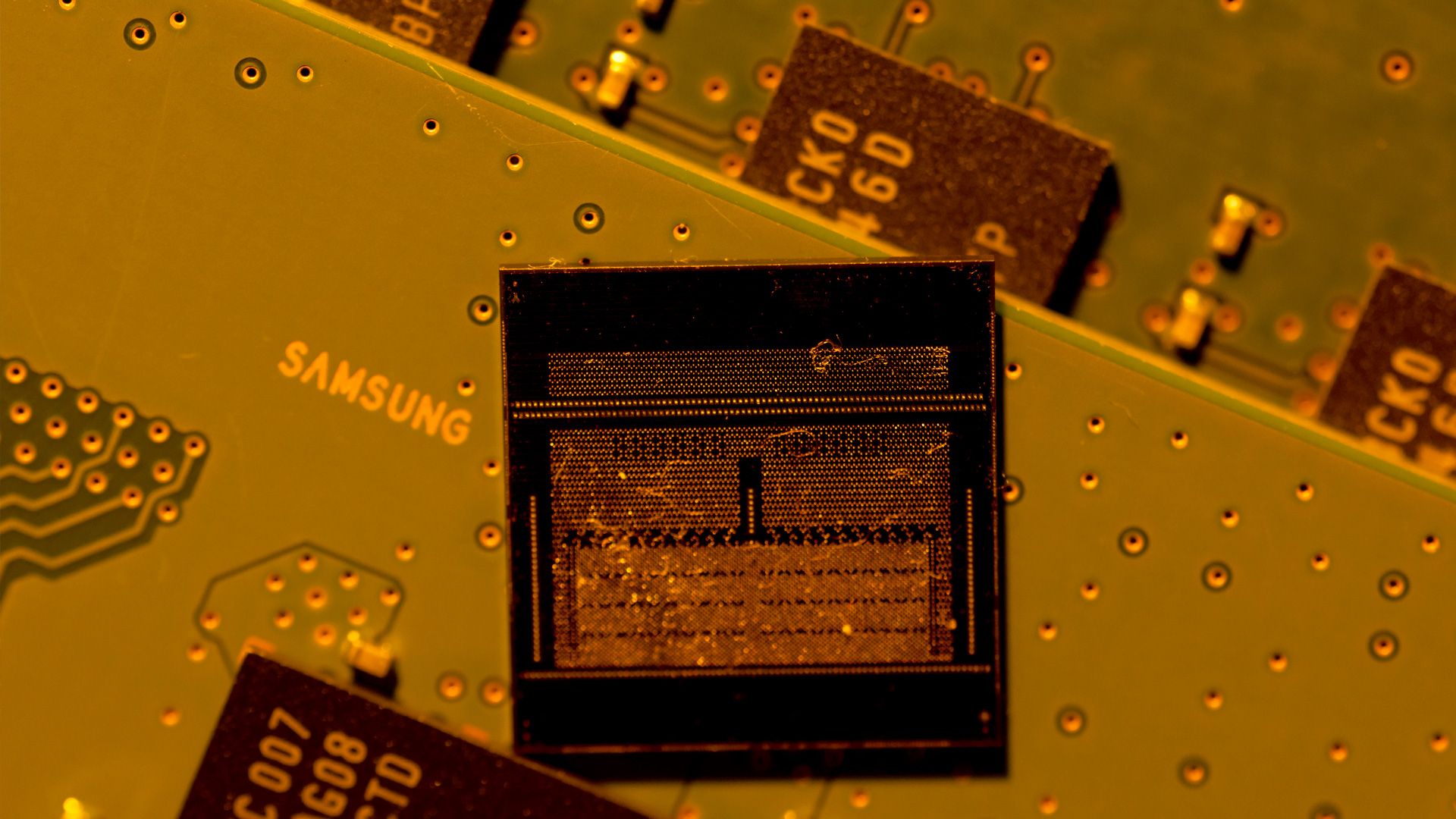

Zaranthos acadia11 said: From who, aside from dram manufacturers acting as a cartel, who is the competition you speak of … you have samsung, sk Hynix, and micron making today’s DDR5 dram if someone could have broken into the cadre they would have done so. These are the folks that can produce the speed and capacities and have the tech to do it today. It’s like saying a new player is going to pop up as a tool manufacturer to compete with ASML or TSMC in leading edge node production. It takes years of investment and oodles of money to build factories and considering the demands if it was that simple would have happened already. The IC market is a mature market not a revolutionary market where new players can just jump in and be advanced enough to to compete. Samsung Electronics Co. Ltd. Winbond Electronics Corporation Nanya Technology Corporation ATP Electronics Inc. Micron Technology Inc. Integrated Silicon Solution Inc. SK Hynix Inc. Powerchip Technology Corporation Kingston Technology Corporation Transcend Information Inc. There are others, and there are new startups in multiple countries. Reply

Zaranthos tamalero said: Didnt these clowns reduce production because of oversupply like a year or so ago? Yes. Reply

hotaru251 again expected. memory makers have been caught colluding in past and they have purposefulyl cut production to raise price (which tbf was justified back then) One company doing it notifies the rest to do it. Its a way to collude w/o having any private conversations and avoid any legal trouble. Reply

Key considerations

- Investor positioning can change fast

- Volatility remains possible near catalysts

- Macro rates and liquidity can dominate flows

Reference reading

- https://www.tomshardware.com/tech-industry/SPONSORED_LINK_URL

- https://www.tomshardware.com/tech-industry/samsung-raises-memory-chip-prices-by-up-to-60-percent-since-september-according-to-reports-ai-data-center-build-out-strangles-supply#main

- https://www.tomshardware.com

- AI On: 3 Ways to Bring Agentic AI to Computer Vision Applications

- Gigabyte X870E Aorus Master X3D Ice Motherboard Review: Icy refresh designed for X3D chips

- Nintendo says it has 'no intention' of blocking third-party Switch 2 docks following firmware update that stopped them from working — accessory makers scramble

- Join the Resistance: ‘ARC Raiders’ Launches in the Cloud

- Fueling Economic Development Across the US: How NVIDIA Is Empowering States, Municipalities and Universities to Drive Innovation

Informational only. No financial advice. Do your own research.